Understanding Advance Pricing Agreements under UAE corporate tax is essential for businesses operating in the UAE with related-party transactions. As the UAE Corporate Tax law matures, the Federal Tax Authority (FTA) has introduced APAs to bring transparency and certainty to transfer pricing—a critical area for multinational enterprises, free zone businesses, and companies with complex intercompany dealings.

What Is an Advance Pricing Agreement under UAE Corporate Tax?

An Advance Pricing Agreement (APA) under UAE Corporate Tax is a formal, voluntary agreement between a taxpayer and the UAE Federal Tax Authority that sets the rules for how the arm’s length price of controlled transactions (transactions between related parties) should be determined over a future period. It essentially locks in the transfer pricing methodology in advance, giving taxpayers clarity on how their related-party transactions will be treated for corporate tax purposes.

This mechanism helps prevent disputes and unexpected adjustments during transfer pricing audits, creating a structured and predictable corporate tax environment for businesses.

Why Advance Pricing Agreements under UAE Corporate Tax Matter?

Advance Pricing Agreements under UAE Corporate Tax are vital because they provide tax certainty and reduce the risk of lengthy and costly disputes with the FTA. By agreeing on pricing methods ahead of time, businesses can align their transfer pricing strategy with regulatory expectations, lowering audit risk and administrative burden.

APAs also foster a collaborative compliance culture between taxpayers and the FTA, which aligns the UAE with global best practices outlined by international tax standards. Over time, this can help reduce or prevent double taxation for cross-border transactions once bilateral APA tiers are introduced.

Types of Advance Pricing Agreements in the UAE

The UAE is implementing its APA framework in phases, beginning with unilateral APAs and later expanding to bilateral and multilateral APAs:

- Unilateral APA (UAPA): This is an agreement strictly between the FTA and the taxpayer. It can cover both domestic and cross-border Controlled Transactions, but it is binding only on the FTA and the applicant. As a result, it offers certainty exclusively from a UAE tax standpoint. However, it may still carry a risk of double taxation if the relevant foreign tax authority does not accept the agreed-upon transfer pricing approach.

Applications for Unilateral APAs relating to domestic Controlled Transactions will be accepted starting December 2025. For cross-border Controlled Transactions, the application process is expected to open in 2026, with the exact commencement date yet to be announced.

- Bilateral APA (BAPA): A Bilateral Advance Pricing Agreement (BAPA) is concluded between the competent authorities of two different jurisdictions through the Mutual Agreement Procedure (MAP). It offers tax certainty for Controlled Transactions by ensuring that the agreed transfer pricing treatment is accepted both in the UAE and in the corresponding foreign jurisdiction.

- Multilateral APA (MAPA): A future phase that includes multiple tax jurisdictions, further reducing the risk of double taxation on multinational group transactions.

The initial focus of the FTA is on rolling out UAPAs first, with bilateral and multilateral APAs to follow once international coordination frameworks are operational.

APA Comparison table quick summary:

| Type of APA | Jurisdictions Involved | Double Tax Risk | Availability |

|---|---|---|---|

| Unilateral APA | UAE only | Possible | From Dec 2025 |

| Bilateral APA | UAE + 1 foreign country | Reduced | Future phase |

| Multilateral APA | UAE + multiple countries | Minimal | Future phase |

Eligibility Criteria for Advance Pricing Agreements

Any taxpayer entering into controlled transactions with related parties—whether domestic or cross-border—can apply for an APA under the UAE Corporate Tax regime, provided they meet the materiality threshold. The common eligibility condition is that the total value of the transactions proposed to be covered is at least AED 100 million per Tax Period.

However, the FTA maintains discretion and may accept applications that fall below this threshold if transactions are highly complex or involve significant transfer pricing risk.

This framework applies to all corporate entities, including mainland businesses, free zone entities, and even individuals who qualify as taxable persons under the law.

Note: 1. Safe harbour transactions are excluded from both:

- The APA scope, and

- The threshold calculation.

Note: 2. For a Tax Group, the AED 100 million threshold applies at the group level.

Critical assumptions underlying an APA

An APA is based on certain critical assumptions, such as:

- facts relating to the Person and its Related Parties,

- industry conditions, and

- general economic factors.

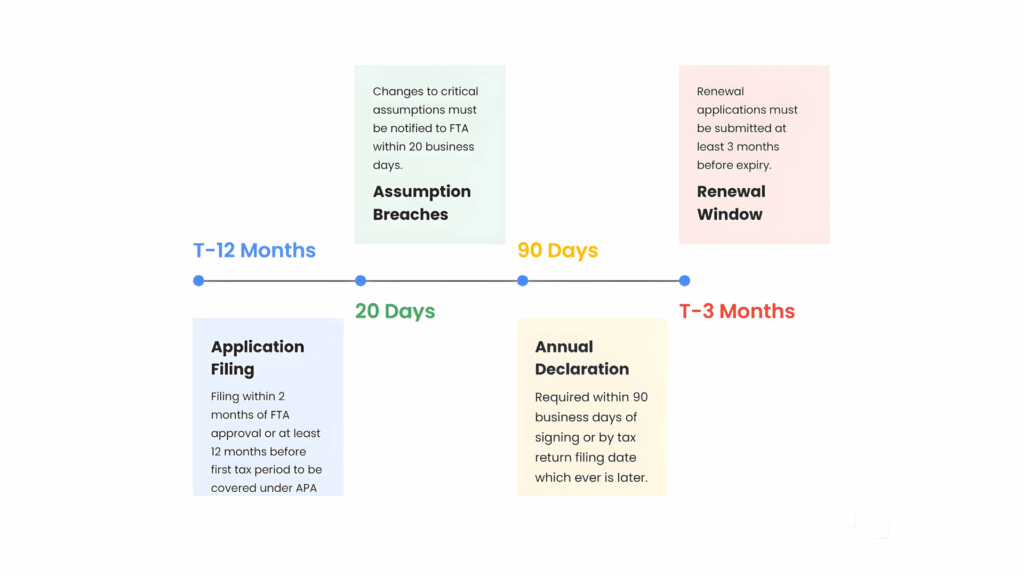

These assumptions are essential for the APA to remain valid. If any change or breach of a critical assumption occurs, the APA may become ineffective.A Person must inform the FTA within 20 Business Days of any modification or violation of critical assumptions.The notification must include a reasonable explanation for the change or breach.

The FTA will review the situation and decide the appropriate action, which may include:

- Revising,

- Cancelling, or

- Revoking the APA.

Benefits of an Advance Pricing Agreement under UAE Corporate Tax

Advance Pricing Agreements under UAE Corporate Tax offer multiple strategic advantages:

- Tax Certainty: APAs provide predictability on how transfer pricing rules apply to controlled transactions, enabling more effective tax planning.

- Risk Mitigation: They significantly reduce the risk of disputes and litigation by agreeing on pricing policies before audits occur.

- Streamlined Compliance: Clearly defined transfer pricing criteria simplify documentation and compliance efforts.

- Double Taxation Prevention: In future phases, bilateral and multilateral APAs will help prevent or alleviate double taxation through cooperative mechanisms with foreign tax authorities.

- Improved Tax Authority Engagement: APAs promote proactive dialogue with the FTA, fostering collaborative compliance rather than adversarial relationships.

Period of an APA:

An APA shall be applied for a minimum of three Tax Periods and a maximum of five Tax Periods. At the initial stage, UAPAs shall only cover prospective periods.

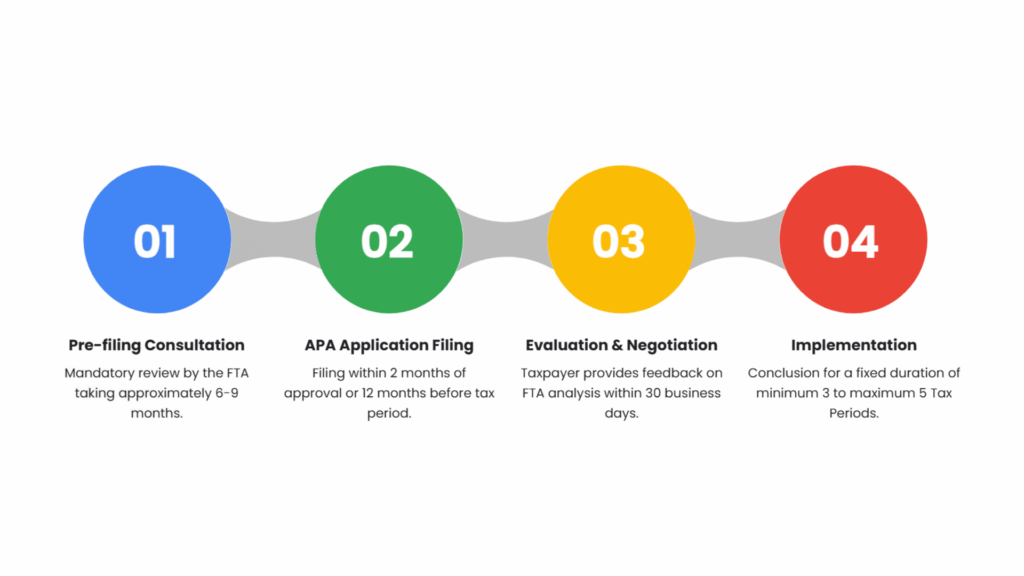

Stages of the APA Process under UAE Corporate Tax

The APA process follows defined stages designed to ensure thorough assessment and alignment:

- Pre-Filing Consultation: This is an initial evaluation stage aimed at determining whether the case is suitable for an APA. During this phase, the Federal Tax Authority (FTA) may conduct one or more consultation meetings, depending on the complexity of the proposed arrangement. The applicant is generally informed of the outcome of the preliminary assessment within 60 business days. If the FTA requests any additional details or clarifications, the required information must be submitted within 40 business days. Once the application is accepted at this stage, the taxpayer is required to formally submit the APA application within the stipulated timeframe

- APA Application: The application undergoes a comprehensive review process, which may include on-site visits, discussions with key personnel, and requests for further information or documentation. An application may be declined for various reasons, such as weak or incomplete economic analysis, misalignment between contractual terms and actual business practices, inadequate supporting records, potential tax avoidance risks, or substantial fluctuations in business operations that affect reliability.

- Evaluation & Negotiation: The FTA conducts its own transfer pricing assessment, which includes determining the most appropriate method, evaluating the pricing framework, and identifying key assumptions. The taxpayer is given 30 business days to review the analysis and submit comments or observations. If the parties are unable to reach an agreement during this stage, the APA application may be discontinued, and any fees already paid will not be refunded.

- Conclusion & Implementation: After completing its evaluation and confirming that the taxpayer has met all the applicable terms and conditions of the APA, the FTA will engage with the taxpayer to discuss the practical implementation of the agreement. Upon reaching a mutual agreement, both parties will formally sign the APA in accordance with the agreed terms.

- Monitoring & Annual Declaration: Each covered tax period requires an APA Annual Declaration verifying compliance with agreed assumptions. The FTA may review, revise, or revoke the APA if necessary.

Deadline for filing APA Annual Declaration: Within 90 business days from signing the APA or by the tax return filing date, whichever is later.

Fees and Renewal for APAs

The APA regime under UAE Corporate Tax includes prescribed fees for processing and renewals:

- Application Fee: AED 30,000 (non-refundable) is payable when submitting the initial APA application.

- Renewal Fee: AED 15,000 for renewing an existing APA, provided the renewal is submitted at least three months before expiry.

These fees reflect the administrative and evaluative resources required to process APA agreements.

Timeline of an APA Application

A UAPA application must be submitted within 2 months from the date of the approval notification of pre-filing consultation by the Authority, or at least 12 months before the start of the first Tax Period to be covered, whichever is earlier.

Strategic Considerations for Businesses

For companies with complex transfer pricing arrangements, such as multinational groups or entities with significant related-party transactions-Advance Pricing Agreements under UAE Corporate Tax are more than compliance tools; they are strategic instruments. Entering into an APA early can reduce future uncertainty, strengthen governance frameworks, and support international expansion plans.

Given the evolving nature of the APA framework, businesses should assess their eligibility, prepare robust documentation, and engage with tax advisors to navigate the process efficiently and maximise the benefits.

Challenges to be considered when going for the APA

The process involves comprehensive documentation and detailed benchmarking analyses, which can be resource-intensive. Additionally, significant time and costs are required to prepare the application and negotiate the agreement with the tax authorities. Once the APA is finalised, the taxpayer must also ensure continuous compliance, regular monitoring, and periodic reporting throughout the term of the agreement.

How MBB Auditing Can Support Your Advance Pricing Agreement (APA)

MBB Auditing provides specialised Transfer Pricing and Corporate Tax advisory services to support businesses navigating Advance Pricing Agreements under the UAE Corporate Tax framework. Our team assists organisations at every stage of the APA lifecycle—from initial feasibility assessment to documentation, negotiation, and ongoing compliance.

With a strong understanding of the UAE Corporate Tax Law, Transfer Pricing provisions, and the OECD Transfer Pricing Guidelines, we help businesses assess whether an APA is suitable for their operational and intercompany transaction profile. Our professionals work closely with clients to prepare robust transfer pricing analyses, define critical assumptions, and align pricing methodologies with both commercial realities and regulatory expectations.

Leveraging our practical experience within the UAE regulatory environment, including Free Zone and mainland structures, we support bilateral and multilateral APA considerations where cross-border transactions are involved. We also assist in coordinating with relevant tax authorities and ensuring that APA positions are consistently reflected in transfer pricing documentation and corporate tax filings.

Whether you are seeking certainty over complex related-party transactions or aiming to mitigate future transfer pricing risks, MBB Auditing offers tailored, commercially focused guidance to help you move forward with confidence. Businesses are encouraged to engage with our team to discuss their specific requirements and determine the most effective APA strategy under UAE Corporate Tax.

Conclusion

Advance Pricing Agreements under UAE Corporate Tax represent a forward-looking step by the UAE Federal Tax Authority to build a transparent, predictable, and internationally aligned transfer pricing regime. They give taxpayers the confidence to manage tax risks proactively, streamline their compliance, and reduce exposure to disputes. As bilateral and multilateral APAs come online in future phases, the framework will further enhance the UAE’s global tax competitiveness and support continued economic growth.